US Dollar Index struggles for direction around 98.20

- DXY alternates gains with losses in the low-98.00s.

- US yields regain upside traction across the curve on Monday.

- The Chicago Fed Index, Chief Powell next on tap in the docket.

The greenback, when tracked by the US Dollar Index (DXY), trades without a clear direction around 98.20 at the beginning of the week.

US Dollar Index looks to Ukraine, Powell

Following Friday’s bounce off weekly lows in the 97.70 region, the index is so far charting an inconclusive session on Monday amidst a mild rebound in US yields and a steady geopolitical front news wise.

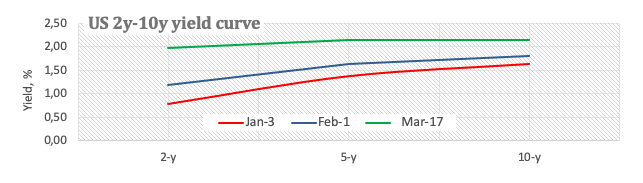

Indeed, the US yield curve continues to flatten following levels past the 2.00% mark in the short end of the curve, while the belly and the long end manage to reverse the recent downside and return to the positive territory.

A light US calendar will see the Chicago Fed National Activity Index and short-term bill auctions ahead of speeches by Atlanta Fed R.Bostic (2024 voter, centrist) and Chief J.Powell.

What to look for around USD

The index managed to bounce off recent sub-98.00 levels following the start of the tightening cycle by the Federal Reserve at its meeting on March 16. Concerns surrounding the geopolitical landscape seem to be propping up the demand for the buck along with the offered stance in the risk-associated complex. Looking at the broader picture, bouts of risk aversion – exclusively emanating from Ukraine - should prop up inflows into the safe havens and lend legs to the dollar at a time when its constructive outlook remains underpinned by the current elevated inflation narrative, the Fed’s lift-off and the solid performance of the US economy.

Key events in the US this week: Chicago Fed National Activity Index, Fed Powell (Monday) – MBA Mortgage Applications, Fed Powell, New Home Sales (Wednesday) – Initial Claims, Durable Goods Orders, Flash PMIs (Thursday) – Final Consumer Sentiment, Pending Home Sales (Friday).

Eminent issues on the back boiler: Escalating geopolitical effervescence vs. Russia and China. Fed’s rate path this year. US-China trade conflict. Futures of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is up 0.03% at 98.25 and a break above 99.29 (high Mar.14) would open the door to 99.41 (2022 high Mar.7) and finally 99.97 (high May 25 2020). On the flip side, the next down barrier emerges at 97.72 (weekly low Mar.17) followed by 97.71 (weekly low Mar.10) and then 97.44 (monthly high Jan.28).