EUR/USD gathers fresh steam above 1.1900 post-NFP

- EUR/USD keeps the positive note and surpass the 1.1900 mark.

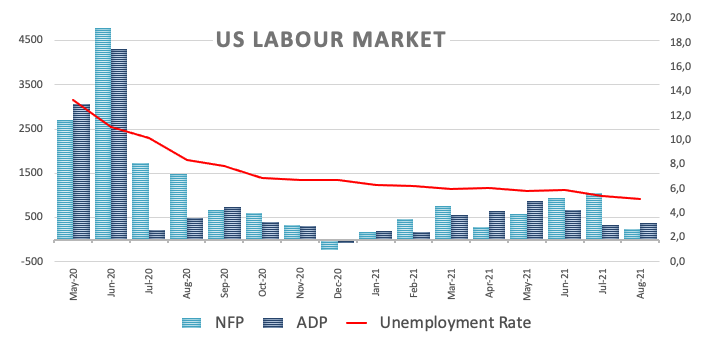

- US Non-farm Payrolls rose by 235K jobs in August.

- The unemployment rate ticked lower to 5.2%.

The buying interest around the single currency remains well and sound at the end of the week and pushes EUR/USD back to the area above the 1.1900 zone, or new multi-day highs, in the wake of US NFP.

EUR/USD in fresh tops around 1.1900

EUR/USD keeps the bid stance on Friday after the US economy created 235K jobs during last month, coming in short of expectations for a gain of 750K jobs. The July's reading was revised to 1053K (from 943K).

Further data showed the jobless rate eased to 5.2% (from 5.4%) and the critical Average Hourly Earnings – a proxy for inflation via wages – rose 0.6% MoM and expanded 4.3% from a year earlier. Another key gauge, the Participation Rate, matched the previous reading at 61.7%.

Other than Payrolls, the final Markit's Services/Composite PMIs are due seconded by the ISM Non-Manufacturing, all during the month of August.

EUR/USD levels to watch

So far, spot is gaining 0.28% at 1.1907 and a break below 1.1815 (55-day SMA) would target 1.1663 (2021 low Aug.20) en route to 1.1612 (monthly low Oct.20 2020). On the upside, the next resistance lines up at 1.1909 (monthly high Sep.3) followed by 1.1951 (100-day SMA) and finally 1.2001 (200-day SMA).