Silver Price Analysis: Bears on the prowl

- XAG/USD bears remain well below the weekly counter-trendline.

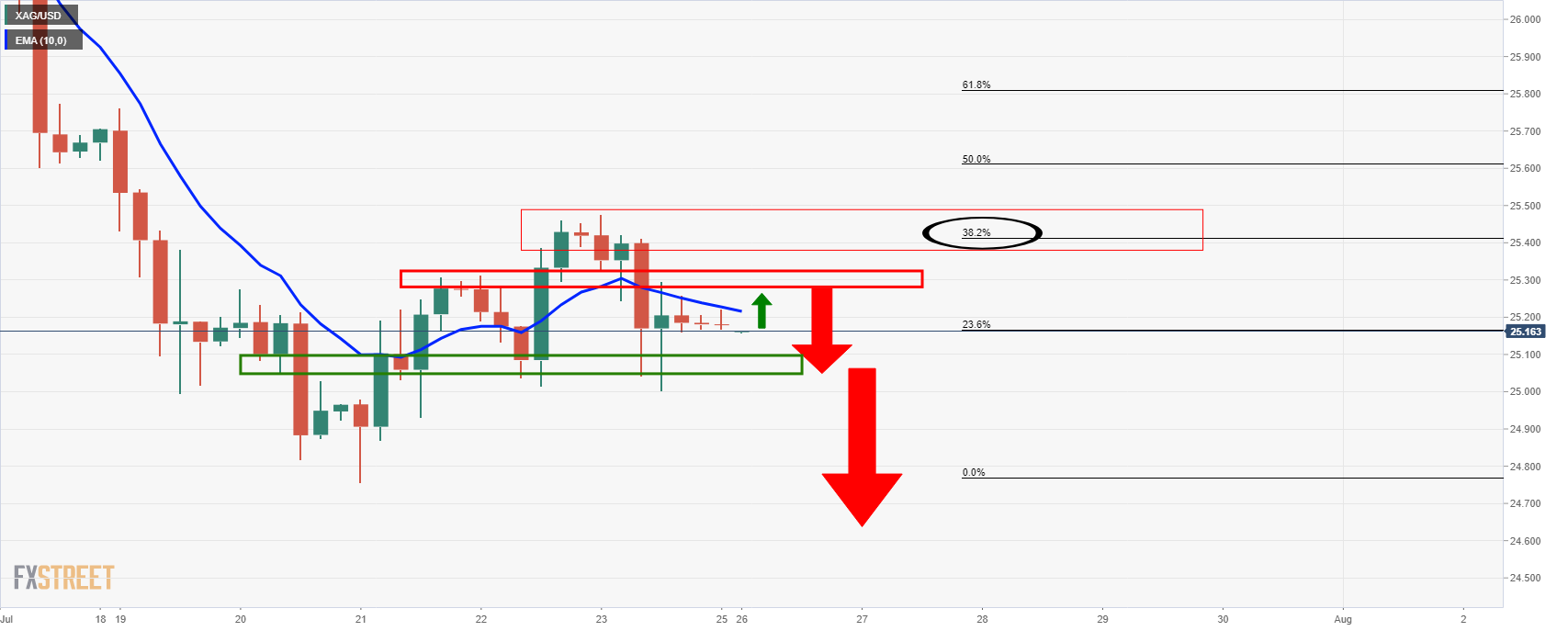

- Silver is developing a bearish head & shoulders in a 4-hour time frame.

Silver is trading at between $25.16 and $25.20 in the open and offered below daily resistance

The following is a top-down analysis that arrives at a bearish conclusion for the white metal.

According to the weekly chart, silver’s bullish trend could well have met its apex and be set for a significant downturn in the coming weeks ahead.

The price has dropped below the dynamic weekly support line and from a daily perspective, the price is below the June-July support between 25.75 and 25.52.

The price has made over a 38.2% Fibonacci retracement and is pressured lower from there which opens prospects of a downside continuation for the days ahead.

However, a bullish start to the week could test the 4-hour 20 EMA that guards 25.31 resistance.

If the bears step in there or below, then the downside extension to test the 24.50s initially and the 24.30s thereafter will be on the cards.

On the flip side, however, a stronger correction will see the 50% mean reversion at 25.60 that meets prior lows daily ahead of the 61.8% Fibo in 25.83.