Copper Price Today: Clocks all-time highs above $4.70, risks a correction

- Copper price races past 2011 highs to refresh record highs.

- Global commodity boom underpins copper amid falling Chinese imports.

- Weaker DXY, Chile’s approval of progressive tax rate also help boost copper.

The price of copper (futures on Comex) is extending its two-day rally, reaching the highest level on record above $4.70, surpassing 2011 highs of $4.6495.

Copper prices continue to draw support from a broadly weaker US dollar, as markets have pushed back the Fed’s tapering bets amid the US central bank’s pledge to continue with its accommodative monetary policy until its employment and inflation goals are achieved. A weaker greenback makes the USD-denominated copper cheaper for foreign buyers.

Further, Chile’s lower house approved a progressive rate on copper sales, which is seen as the heaviest tax burden in global mining and it could affect investments, in turn, boosting copper prices. Chile is the world’s leading copper-producing country.

Amid the ongoing uptrend, copper bulls ignore the reports that Chinese copper imports have fallen nearly 13% in April, as higher prices deter the buyers. Meanwhile, Comex copper tracks the futures on LME higher, the bulls took out the critical $10,000 levels on LME earlier this week.

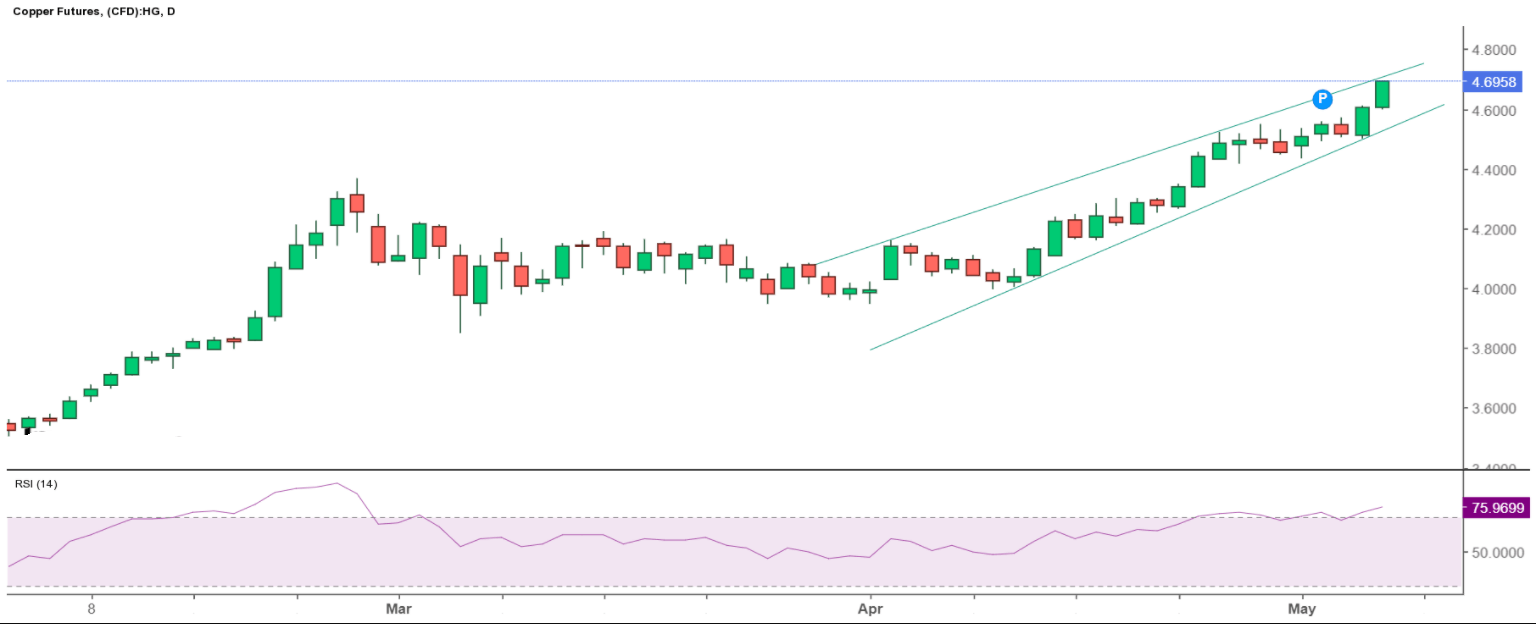

Price of copper: Daily chart

Copper’s daily chart shows that the relentless rise in the prices has driven the 14-day Relative Strength Index (RSI) well into the overbought territory. This suggests that the price of copper risks a corrective pullback any time soon.

Copper prices are closing in on the upper boundary of the one-month-old rising wedge at $4.7088, which also backs a case for a potential move lower.

However, any pullbacks could be a good dip-buying opportunity, as the commodity supercycle seems to have just begun. Copper prices are up almost 29% so far this year.