USD/CAD Outlook: Seems vulnerable to retest multi-year lows, around 1.2365 area

- Last week’s hawkish BoC policy outlook continued weighing heavily on USD/CAD.

- Mixed US Durable Goods Orders failed to impress the USD bulls or lend support.

- Rebounding oil prices underpinned the loonie and contributed to the selling bias.

The USD/CAD pair witnessed some heavy selling on the first day of a new trading week and dived to the lowest level since March 18. This marked the second consecutive day of a negative move – also the third in the previous four – and was sponsored by a combination of factors. The Canadian dollar continued reacting positively to last week's more hawkish BoC decision to reduce its weekly asset purchases and bring forward the guidance for the first interest rate hike to the second half of 2022.

On the other hand, the US dollar dropped to fresh multi-week lows amid expectations that the Fed will keep interest rates low for a longer period. Apart from this, the underlying bullish sentiment in the financial markets and subdued US Treasury bond yields further undermined the safe-haven greenback. Prospects for a strong global economic recovery from the pandemic continued boosting investors' appetite for perceived riskier assets, which was evident from the recent rally in the equity markets.

On the economic data front, the US Durable Goods Orders rose 0.5% MoM in March as against consensus estimates pointing to a growth of 2.5%. However, orders excluding transportations matched expectations and increased 1.6% during the reported month. The mixed data did little to impress the USD bulls or lend any support to the major.

Meanwhile, the risk-on mood, to a larger extent, helped offset worries that surging COVID-19 cases in India and Japan – the world’s third and fourth-biggest oil importers – will drive down fuel demand. This, in turn, led to a goodish intraday bounce in crude oil prices, which provided an additional boost to the commodity-linked loonie and contributed to the pair's overnight decline to sub-1.2400 levels. That said, the expected supply increase from OPEC+ acted as a headwind for the commodity.

Nevertheless, the pair settled near the lower end of its daily trading range, albeit lacked any follow-through selling, instead regained some positive traction during the Asian session on Tuesday. Market participants now look forward to the release of the Conference Board's US Consumer Confidence Index and a speech by the BoC Governor Tiff Macklem for some impetus. The market reaction is likely to be limited as investors might prefer to wait on the sidelines ahead of the latest FOMC monetary policy decision, scheduled to be announced on Wednesday.

Short-term technical outlook

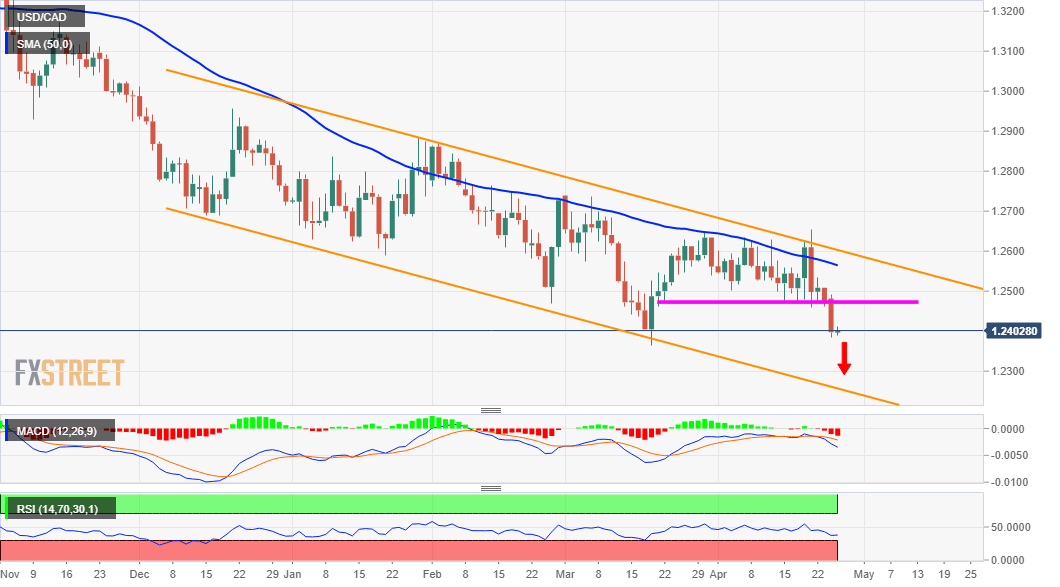

From a technical perspective, the overnight fall validated the recent bearish break below the 1.2475-70 region. A subsequent slide below the 1.2400 mark might have already set the stage for additional weakness. Hence, some follow-through decline back towards challenging multi-year lows, around the 1.2365 region, now looks a distinct possibility. The mentioned area coincides with the lower boundary of a multi-week-old descending channel, which if broken decisively should pave the way for the resumption of the prior well-established downward trajectory witnessed over the past year or so.

On the flip side, any meaningful recovery attempt might now confront stiff resistance near the 1.2470-75 support breakpoint. This is closely followed by the key 1.2500 psychological mark, above which a bout of short-covering has the potential to lift the pair towards an intermediate hurdle near mid-1.2500s. The upside, however, is more likely to remain capped near the trend-channel barrier, currently around the 1.2585 region.