NZD/USD price trapped with short-term downside bias

- NZD/USD trapped in a sideways channel with no longer-term direction bias.

- Bears on lower time frames seek retest of channel support.

NZD/USD is currently trading at 0.7191 between a low of 0.7170 and a high of 0.7217 as we head into the close of Wall Street on a day where global markets have kicked off the week with a risk-off tone

Fixed income is on vouge as headlines emerge that Biden’s fiscal package might not get voted on until mid-March.

At the same time, investors are wary about towering stock market valuations amid questions over the efficacy of the vaccines in curbing the pandemic.

Meanwhile, NZD positioning continued to move higher in the latest CFTC report despite already being the biggest G10 speculative long.

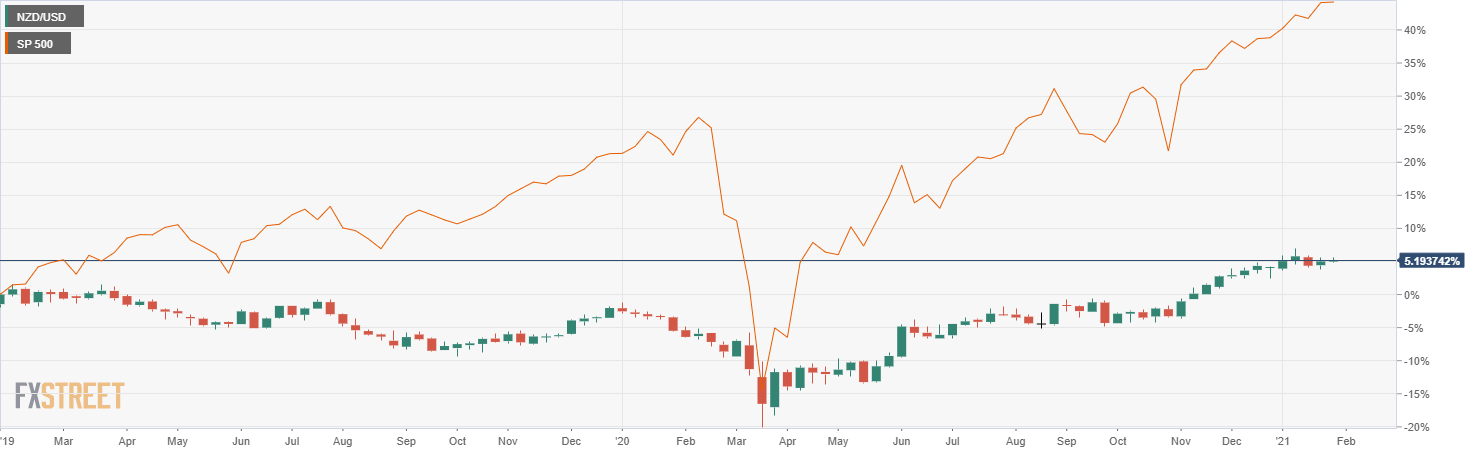

The high beta currencies may start to falter, however, if US stocks take a turn for the worst. See the chart below.

Looking ahead, it is going to be a busy week, ''but ultimately one that could see the current period of consolidation in the dollar extend a while further,'' analysts at ANZ Bank argued.

''Foremost, the FOMC meeting will be dovish. While fiscal developments are welcome, the US labour market, inflation and consumption data have been very weak recently,'' the analysts explained.

''Amid very high levels of infections, it is very difficult for a self-sustaining recovery to take hold amid disruption to key areas of services. As the market flip flops between the weak data and the brighter outlook, NZD/USD can remain range bound.''

NZD/USD technical analysis

The above chart is a long term picture and comparison of the S&P500 index to NZD/USD.

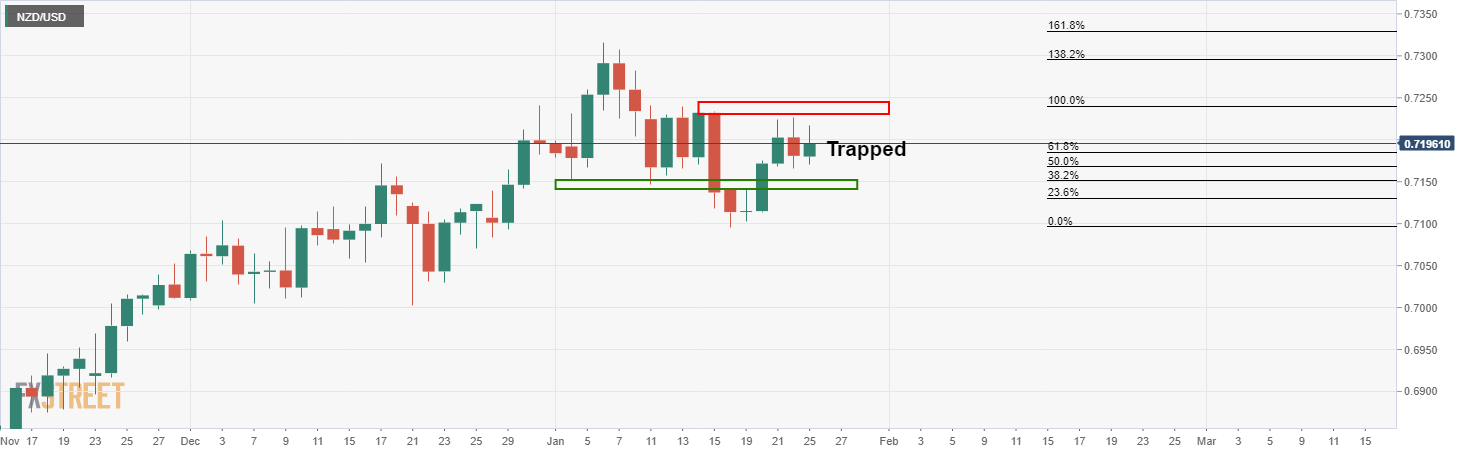

Meanwhile, from a spot basis and on the daily time frame, the price is trapped between support and resistance:

Until the price breaks out, one way or the other, there is little that can be done with this pair from a swing trading perspective.

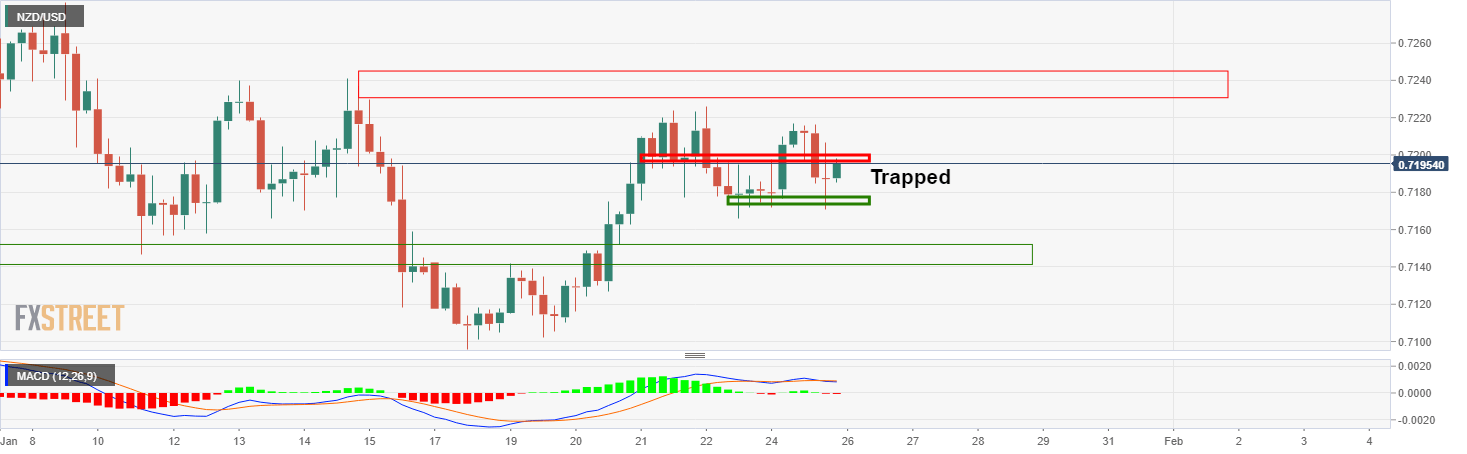

The 4-hour chart is much of the same range-bound trapped scenario.

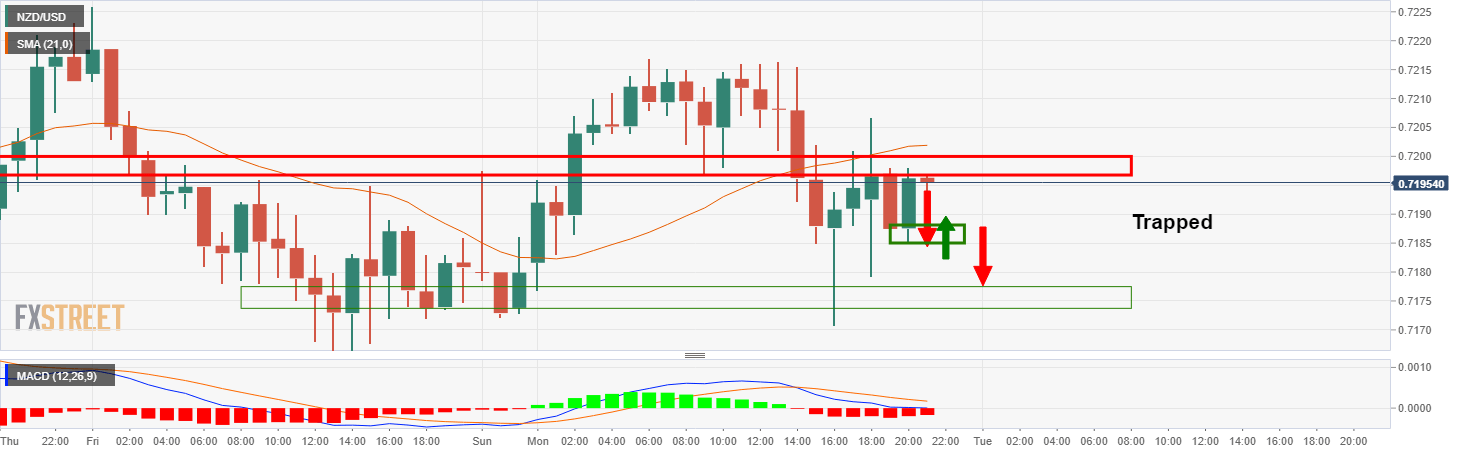

1-hour downside bias

From a 10hour perspective, the bias is to the channel support on a break of the rest lows while below the 21 moving average.