USD/INR Price News: Indian rupee sellers aim for monthly trend line above 73.00

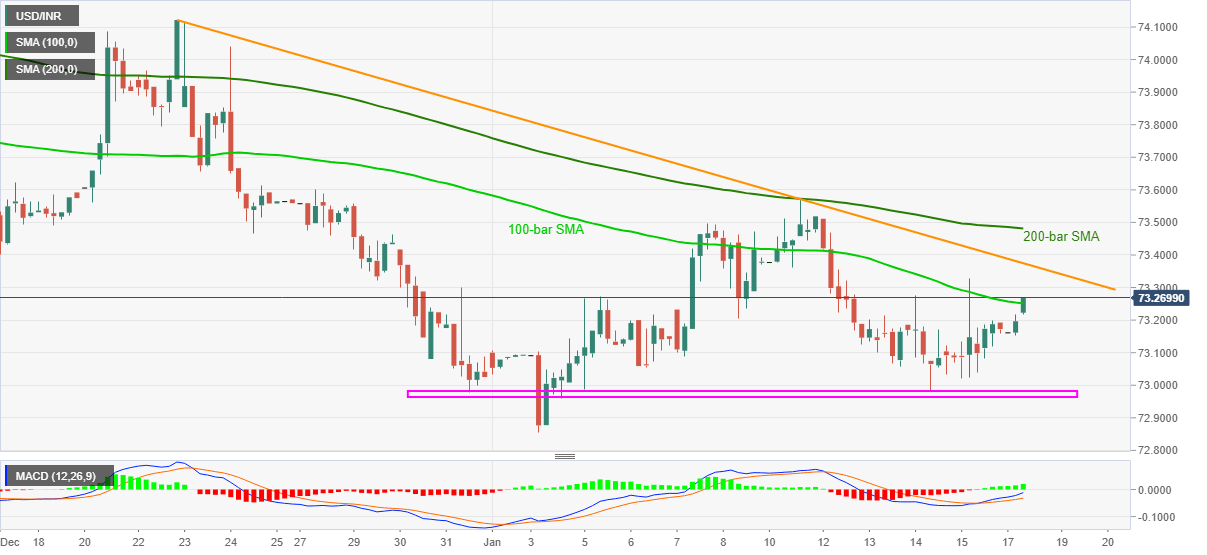

- USD/INR pierces 100-bar SMA while extending Friday’s upside.

- Bullish MACD favor pair buyers, 200-bar SMA adds to the resistance.

- Monthly horizontal support restricts short-term downside ahead of 72.85.

USD/INR remains on the front foot near 73.24, up 0.10% intraday, during the initial Indian trading session on Monday. In doing so, the quote pierces 100-bar SMA amid bullish MACD while stretching Friday’s recovery moves.

However, a downward sloping trend line from December 22, at 73.38 now, followed by a 200-bar SMA level of 73.48, probe the USD/INR buyers.

Also acting as an upside barrier is the monthly peak surrounding 73.56 and December 23 low near 73.65.

In a case where the USD/INR bulls manage to cross 73.65, the previous month’s peak near 74.12 should return to the charts.

Meanwhile, failures to stay above 100-bar SMA, currently around 73.25, can fetch the quote back to a horizontal area comprising multiple lows marked since December 31, around 73.00-72.96.

During the USD/INR weakness past-72.96, the monthly low of 72.85 and September’s bottom close to 72.75 will lure the bears.

USD/INR four-hour chart

Trend: Bullish