Back

12 Jun 2020

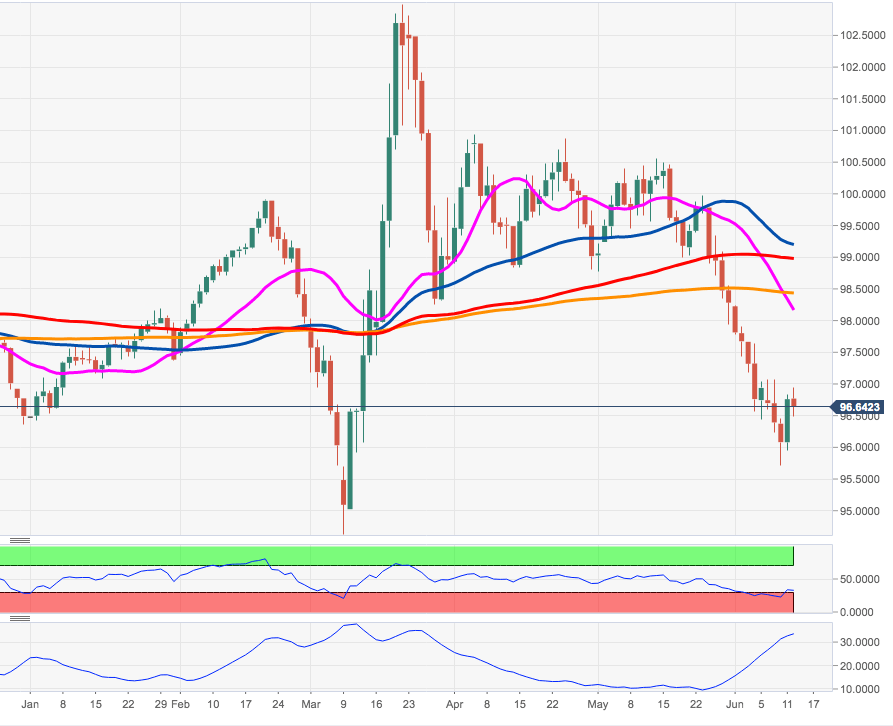

US Dollar Index Price Analysis: Remains bearish and targets 95.00

- DXY has so far met resistance in the 97.00 region this week.

- A convincing breakdown of 96.00 could allow for a test of 95.00.

Thursday’s moderate rebound in DXY lacked follow through and run out of steam in the 97.00 area.

Immediately to the downside emerges the 3-month low at 95.72 (June 10), while a deeper pullback is expected to reach the 2019 low in the 95.00 neighbourhood.

While capped by the 200-day SMA, today at 98.42, the dollar is expected to keep the negative view unchanged.

DXY daily chart