Back

11 Jun 2020

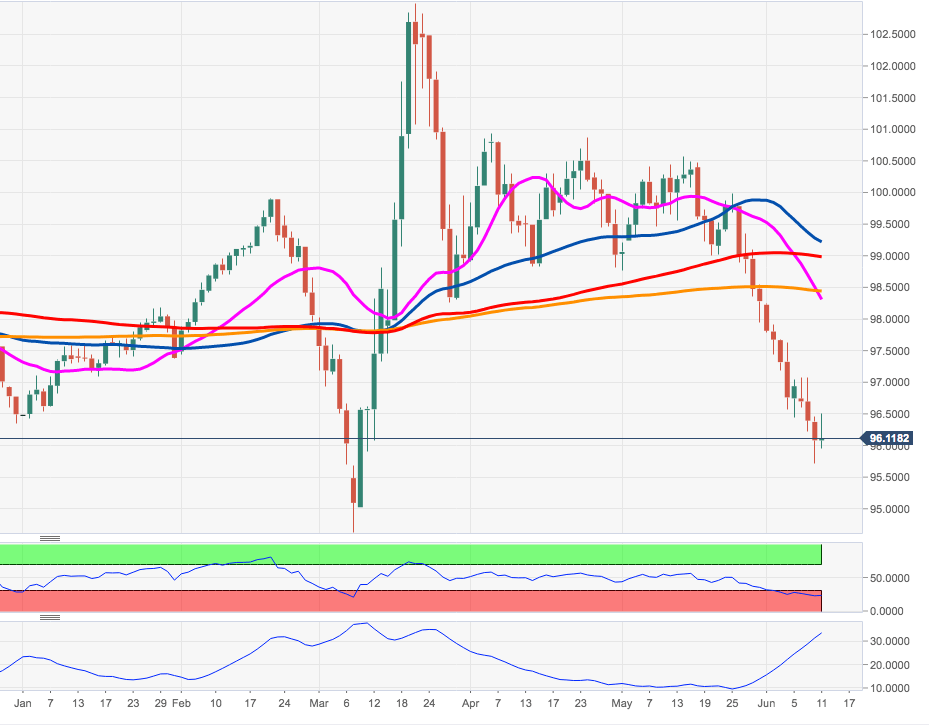

US Dollar Index Price Analysis: Next on the downside emerges the 95.00 mark

- DXY briefly broke below the 96.00 support on Wednesday.

- A convincing breakdown of 96.00 could allow for a test of 95.00.

Despite the ongoing rebound, the outlook on DXY looks bearish in the short-term horizon.

The index briefly breached the 96.00 level on Wednesday but closed the session above it. This area of support coincides with a Fibo retracement (of the 2017-2018 drop).

If sellers remain in control of the market, then a potential drop to the 2019 low at 95.03 should start to gather some traction.

DXY daily chart