Back

27 Apr 2020

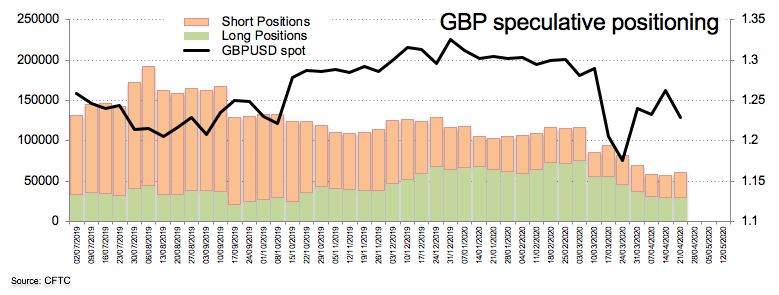

CFTC Positioning Report: GBP returns to the negative ground

These are the main highlights of the CFTC Positioning Report for the week ended on April 21st:

- Speculators increased their gross shorts in the British pound during last week, taking the net position to the negative territory for the first time since mid-December 2017. The impact of the coronavirus on the UK economy, probable extra easing from the BoE and rising uncertainty around the upcoming UK-EU trade negotiations are probably (far) too much to handle for the quid for the time being.

- EUR net longs remained on the rise despite the downtrend in spot EUR/USD during the week. The current account surplus in the broader Euroland remains supportive of a firm currency, or at least limits the downside. In addition, positive developments from the coronavirus in Italy and Spain acted as some form of extra contention.

- USD net longs climbed to the highest level since March 3 on the back of persistent demand for the safe haven universe and despite the massive amount of stimulus already running in the US economy as well as diminishing funding stress.

- Crude Oil net longs rose to levels last seen in early August 2018 on the back of increasing short covering following Monday’s meltdown in prices of the May contract.