GBP/JPY moves lower as 2 MPC members vote for a cut

- BoE's Saunders and Haskel vote for a 25bps cut

- In an initial reaction GBP/JPY fell to print below 140.00

GBP/JPY moved lower in an initial reaction as the vote for a rate move changed from 9-0 to 7-2. The market had expected a 9-0 vote again.

Two MPC members voted for a cut. BoE's Haskel and Saunders both felt a 25bps cut was needed.

Before the event, the market is pricing in a 14.57bps cut for the whole of next year. After the event, it is now up to a 16bps cut.

Rates and asset purchases were unchanged as expected but it was noted the BoE changed their Brexit assumption to be based on an orderly transition to Canada-style free trade agreement over the next few years.

BoE forecast sees GDP in 2019 +1.4% vs August forecast of +1.3%, 2020 +1.2% vs August . +1.3%, 2021 +1.8% vs August +2.3%, and lastly 2022 +2.0%.

The inflation outlook has also changed, BoE forecast shows inflation in one year's time at 1.51% vs Previous projection of 1.90%.

BoE forecast shows inflation in two years' time at 2.03% vs previous forecast 2.23%.

BoE forecast shows inflation in three years' time at 2.25% previous forecast 2.37%.

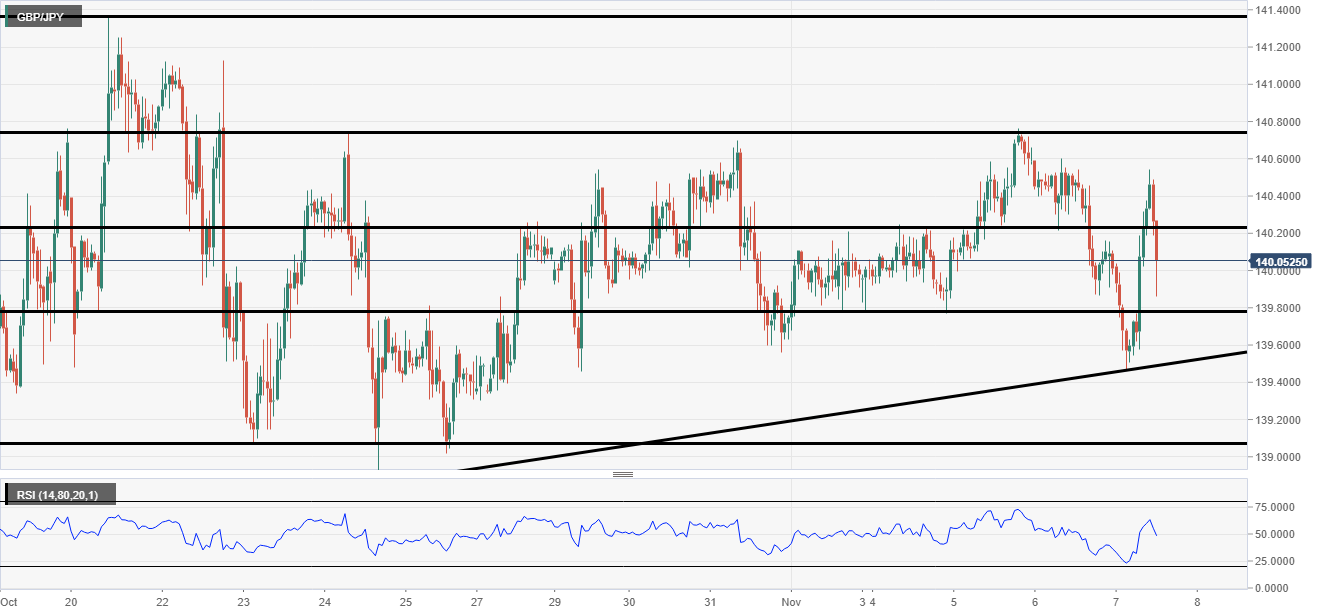

Looking at GBP/JPY now, you can see the price moved lower on the hourly chart below.

The price shot through the support level of 140.00 and may test the 139.80 level. Below that there is also trendline support that it may have to contend with.

On the topside, 140.73 could be held as the sentiment seems to be dovish.