Back

22 Mar 2019

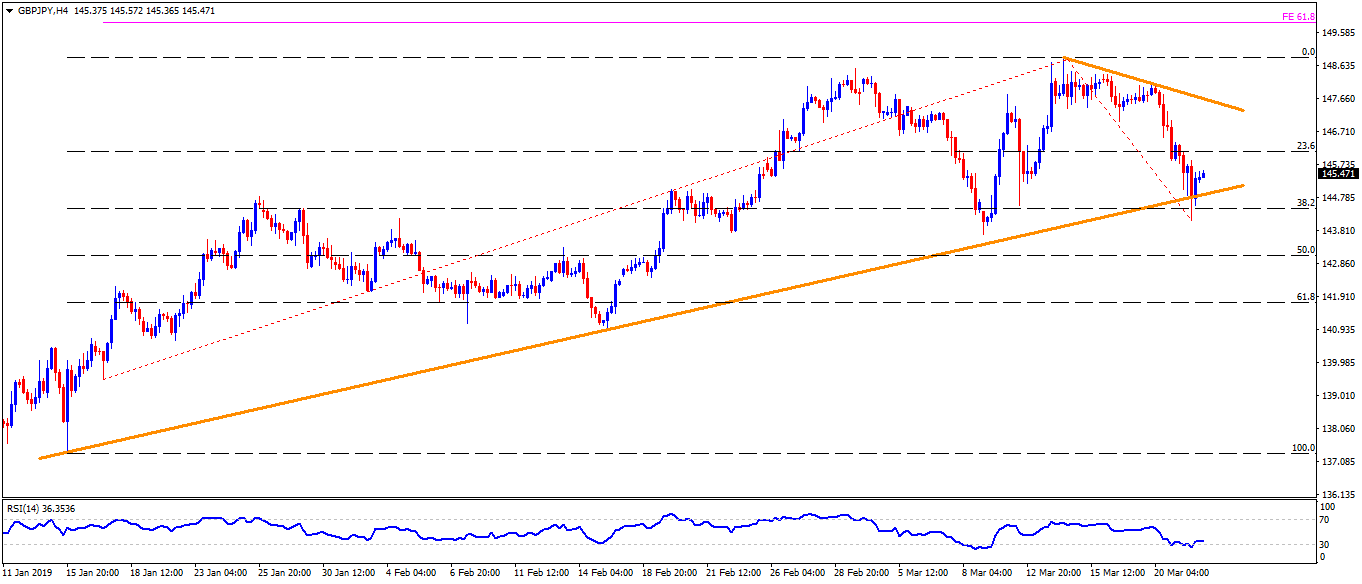

GBP/JPY Technical Analysis: 5-week old ascending trendline restricts the downside near 144.80/70

- GBP/JPY is trading near 145.50 before the UK markets open on Friday.

- The quote recently took a U-turn from 5-week long ascending trend-line and may rise to 145.90 ahead of aiming the 23.6% Fibonacci retracement of mid-January to March upside, at 146.15.

- Should the pair manage to clear 146.15, 147.00 and an immediate downward sloping trend-line at 147.70 could lure buyers.

- Also, pair’s sustained rise past-147.70 can help it aim for 148.90, 149.00 and 61.8% Fibonacci expansion (FE) level near 150.00.

- Alternatively, pair’s break of adjacent support and a consecutive slide beneath 144.70 becomes pre-requisite for sellers to slip in while looking for 143.70.

- In a case where prices keep declining under 143.70, 50% Fibonacci retracement level of 143.00, followed by 142.45 and 141.70, can please bears.

GBP/JPY 4-Hour chart