Back

21 Mar 2019

US Dollar Index Technical Analysis: DXY bulls reverse Fed-inspired drop

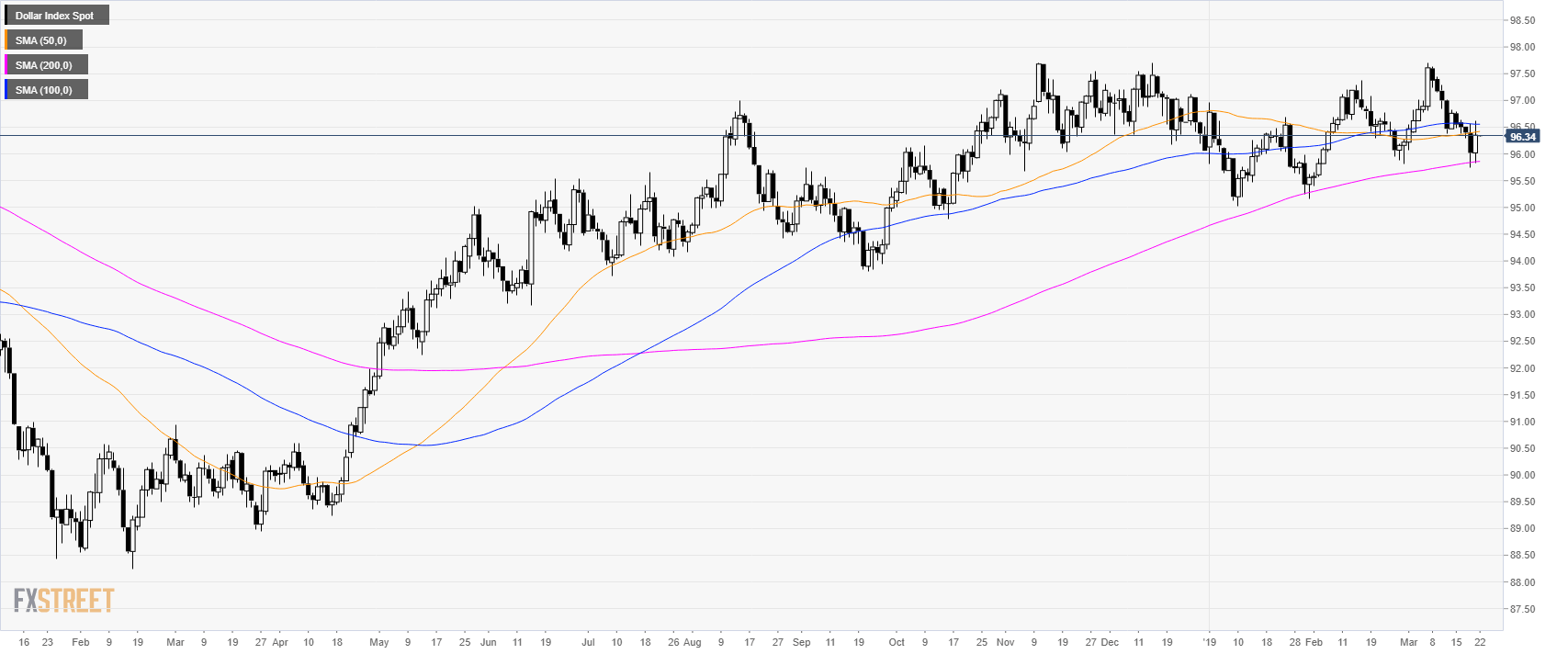

DXY daily chart

- The US Dollar Index (DXY) is trading in a bull trend above its 200-day simple moving average (SMA).

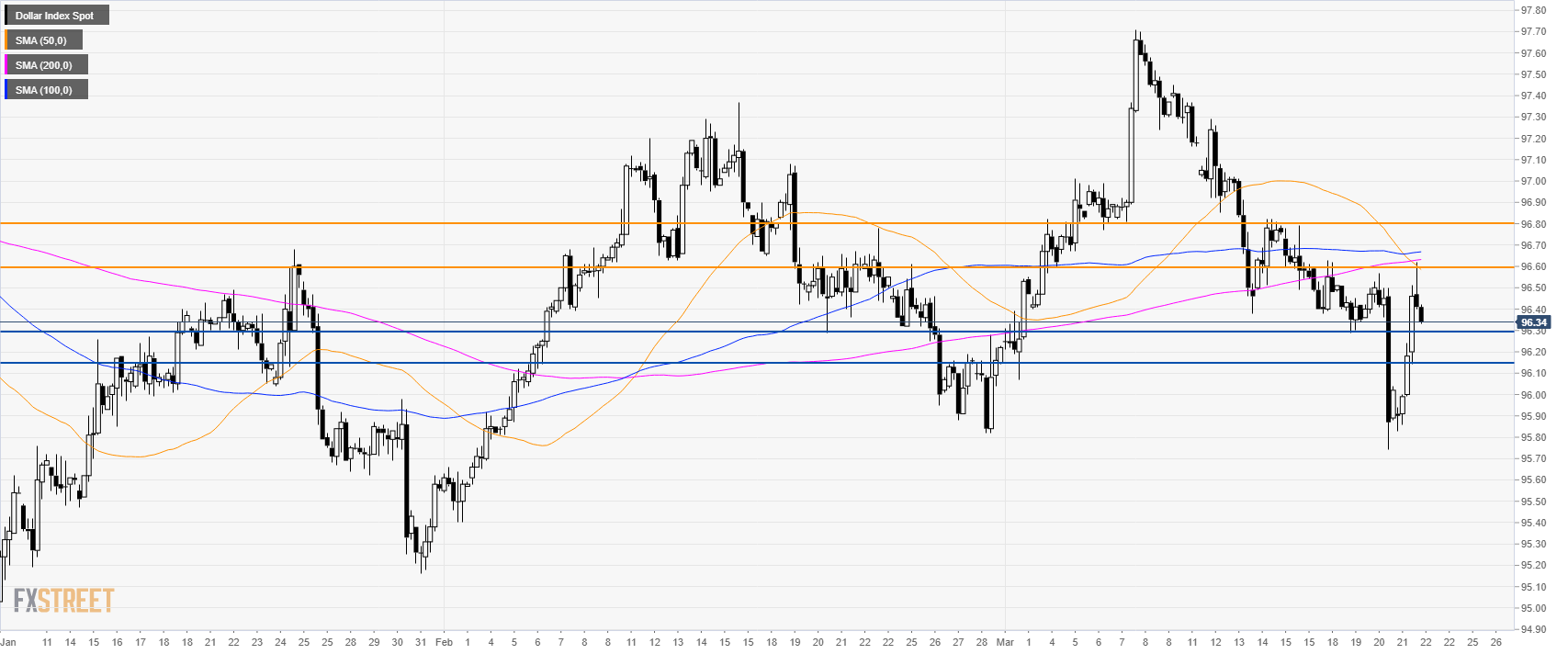

DXY 4-hour chart

- DXY is trading below its main SMAs suggesting bearish momentum in the medium-term.

- Support is at 96.30 and 96.15.

- To the upside, resistance is seen at 96.60 and 96.80 level.

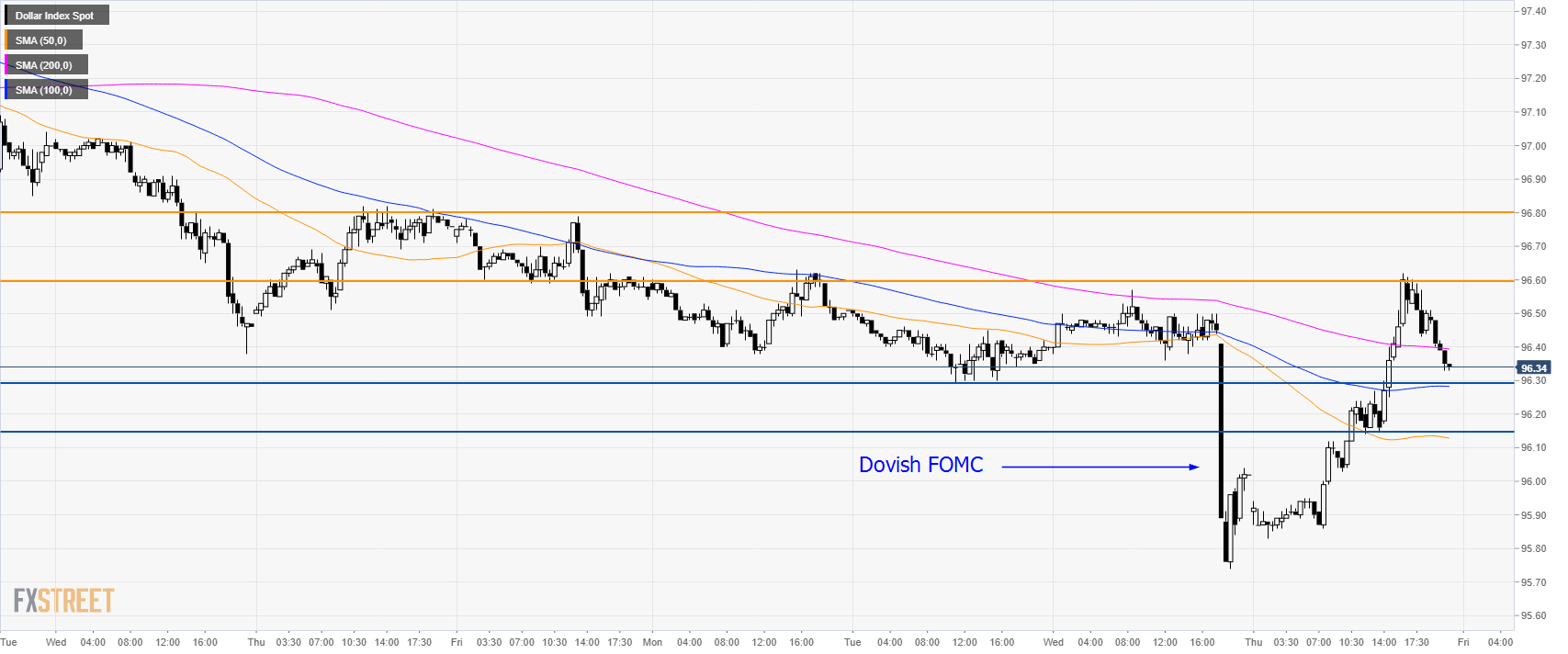

DXY 30-minute chart

- DXY is trading between the 100 and 200 SMAs suggesting a consolidation phase in the short-term.

- On Wednesday the FOMC was much more dovish than expected leading to a huge drop in the Dollar, however, bulls have already erased the loss this Thursday.

Additional key levels