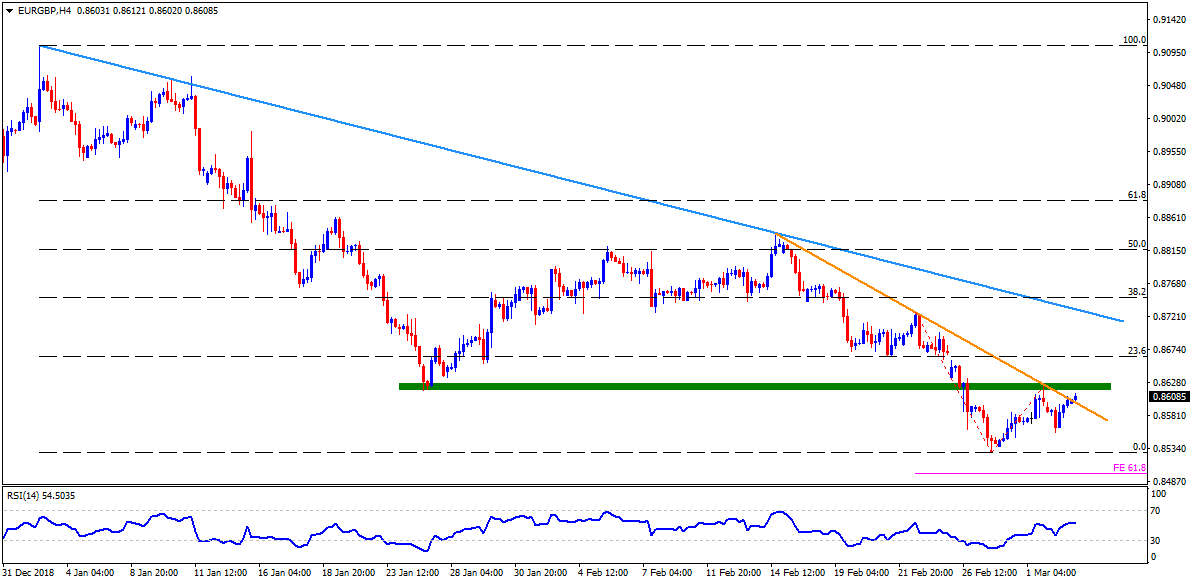

EUR/GBP Technical Analysis: Buyers aim for 0.8617/27 region after clearing immediate resistance-line

- EUR/GBP is taking bids around 0.8610 before European sessions on Tuesday.

- The pair recently crossed immediate trend-line resistance that joined highs marked since February 14.

- As a result, the region comprising January lows and present month high around 0.8617-27 gains buyers’ attention.

- Should prices rally beyond 0.8627, 23.6% Fibonacci retracement of January – February dip, at 0.8665, followed by 0.8725 and another downward sloping trend-line at 0.8735, could please the Bulls.

- If the pair fails to hold its post breakout strength, 0.8560 and 0.8530 are likely nearby numbers to appear on the chart.

- Additionally, pair’s decline beneath 0.8530 might not refrain from visiting the 61.8% Fibonacci expansion of its recent moves around 0.8500 mark.

EUR/GBP 4-Hour chart

Additional important levels:

Overview:

Today Last Price: 0.861

Today Daily change: 2 pips

Today Daily change %: 0.02%

Today Daily Open: 0.8608

Trends:

Daily SMA20: 0.8706

Daily SMA50: 0.8806

Daily SMA100: 0.884

Daily SMA200: 0.8859

Levels:

Previous Daily High: 0.861

Previous Daily Low: 0.8558

Previous Weekly High: 0.8702

Previous Weekly Low: 0.8529

Previous Monthly High: 0.8842

Previous Monthly Low: 0.8529

Daily Fibonacci 38.2%: 0.859

Daily Fibonacci 61.8%: 0.8578

Daily Pivot Point S1: 0.8574

Daily Pivot Point S2: 0.8539

Daily Pivot Point S3: 0.8521

Daily Pivot Point R1: 0.8627

Daily Pivot Point R2: 0.8645

Daily Pivot Point R3: 0.8679