Gold review: Greeenback remains the focal point

- Gold dropped sharply on Tuesday as the uptick in the treasury yields pushed up the dollar index.

- Recent low of $1,160 could be put to test if the US wage growth numbers, due this Friday, beat estimates.

Currently, gold is trading at $1,194, having hit a 10-day low of $1,190.

The metal's biggest nemesis - the US dollar - picked up a bid yesterday, possibly due to a rise in the 10-year treasury yield to a three-week high of 2.90 percent.

The USD exchange rate, as represented by the dollar index, clocked a 14-day high of 95.74 yesterday, and was last seen trading at 95.29.

The pullback from the highs seen yesterday has likely helped the yellow metal recover from $1,190 to $1,194.

Focus on US wage growth

The data, due for release this Friday, is expected to show the average hourly earnings rose 2.8 percent year-on-year in August, following a 2.7 percent rise in July.

An above-forecast reading could trigger fears of economic overheating, something the Fed will likely counter by raising rates above the neutral territory and hence could lead to broad-based USD rally and drop in gold to $1,200.

On the other hand, a weaker-than-expected print could yield a stronger corrective rally in the yellow metal.

Technically speaking, $1,214.30 (Aug. 28 high) is the level to beat for the bulls.

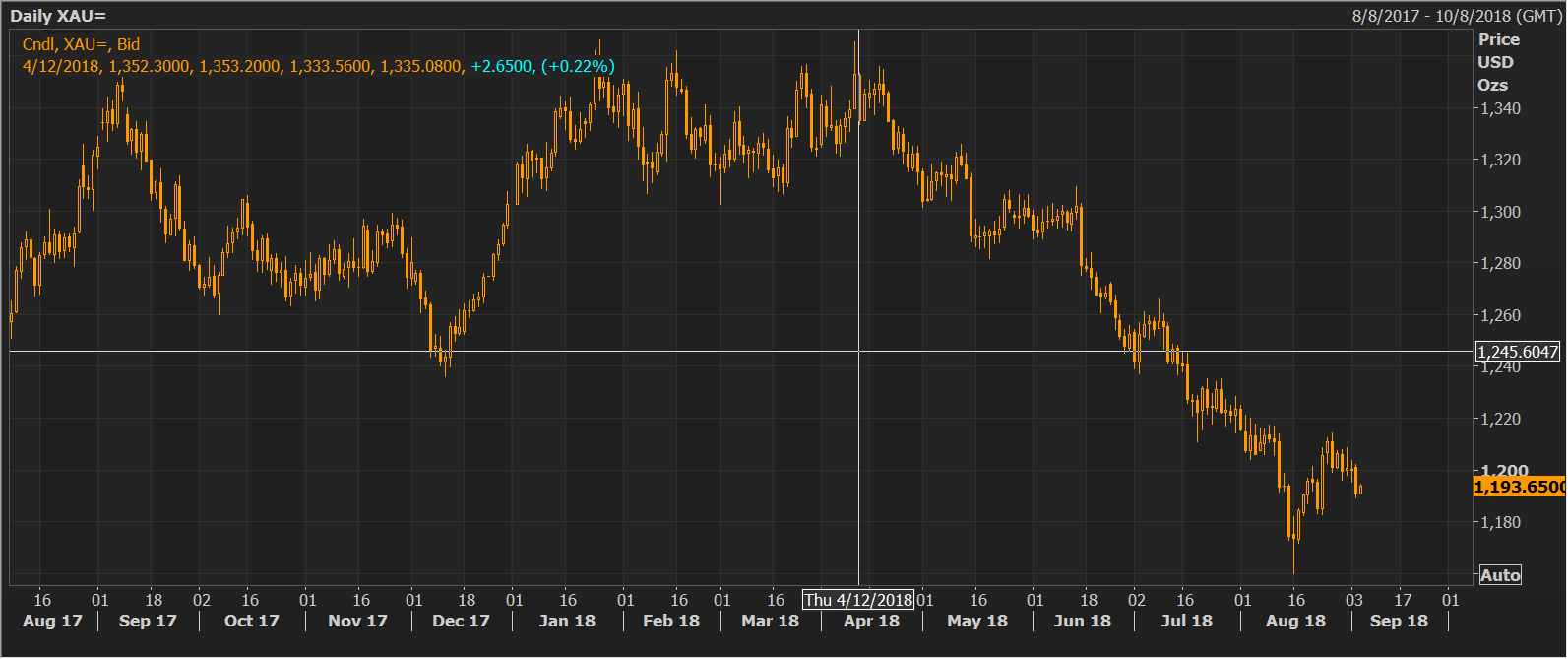

Daily Chart

Resistance: $1,202 (previous day's high), $1,204.59 (Aug. 3 low), $1,214.30 (recent high)

Support: $1,189 (previous day's low), $1,183 (Aug. 24 low), $1,180.97 (61.8% Fib R of $1,160/$1,214.30)