USD/CAD bounces off lows on CPI, Retail Sales

The Canadian Dollar stays on the firm note on Friday, now taking USD/CAD to the 1.3585/90 band after a brief test of daily lows near 1.3550.

USD/CAD remains negative on data

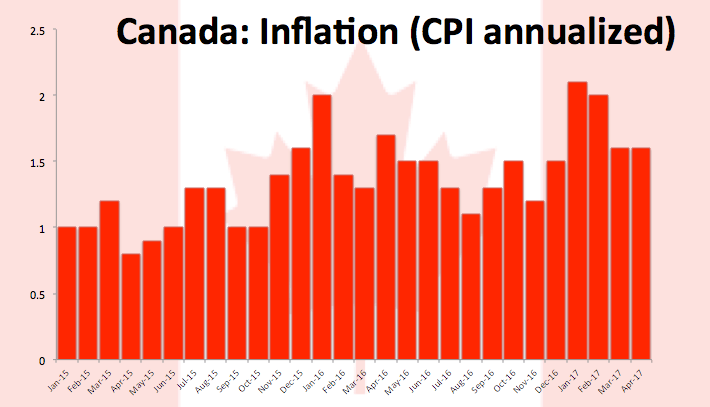

The pair saw its decline accelerated after Canadian inflation figures tracked by the CPI rose less than expected 1.6% on an annualized basis (vs. 1.7% forecasted) and 0.4% inter-month during last month.

Further data saw Core CPI measured by the Bank of Canada rising 1.1% over the last twelve months and coming in flat on the monthly gauge.

In addition, headline Retail Sales expanded at a monthly 0.7% in March, surpassing estimates, while sales excluding the Autos sector contracted 0.2%.

The pair’s downside remain well and sound on the back a renewed and strong pick up in the selling interest around the buck, while higher crude oil prices continue to lend oxygen to CAD.

USD/CAD significant levels

As of writing the pair is losing 0.12% at 1.3786 and a break below 1.3554 (low May 19) would open the door to 1.3508 (50% Fibo of the April-May rally) and finally 1.3480 (55-day sma). On the flip side, the next up barrier is located at 1.3649 (20-day sma) seconded by 1.3659 (23.6% Fibo of the April-May rally) and then 1.3671 (high May 18).